We always look to expand our team with highly motivated individuals, with a strong academic track record, who aspire to work in a dynamic environment where excellence, engagement, entrepreneurship and responsibility are supported.

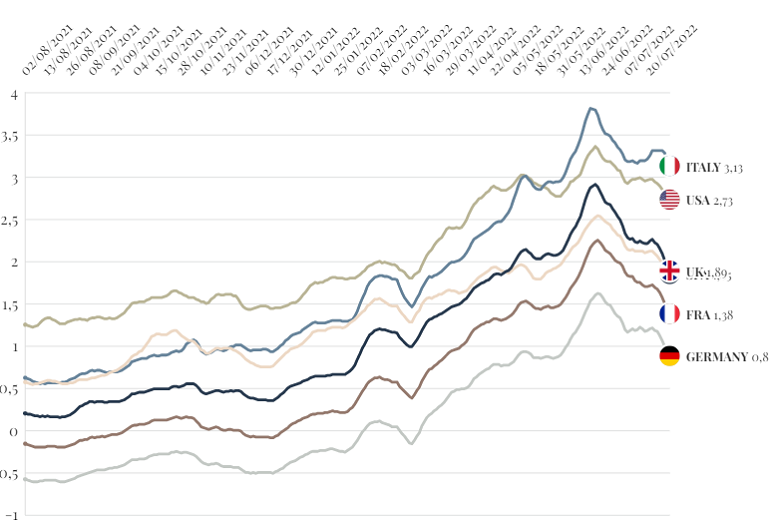

The recent increase in public securities’ yields is combined with the return of a significant inflation following several years of substantial stagnation in consumer prices. The graph shows Italy’s 10-year bond yield, along with those on German Bund, US Treasury bonds and the corresponding French, English and Spanish government bonds for the period between August 2021 and July 2022.

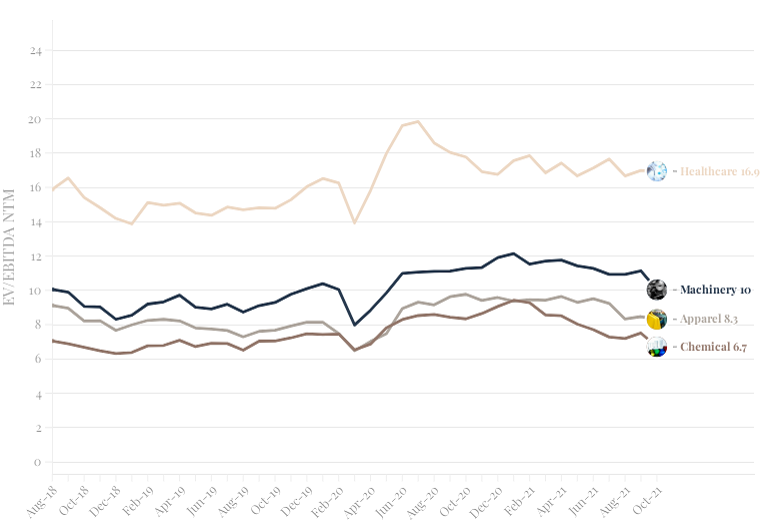

The healthcare sector has always showed high prices, a condition that worsened following the Covid-19 pandemic. The graph compares the pre and post-pandemic EV/EBITDA multiple trend of Healthcare sector with that of Machinery, Apparel and Chemical sectors.

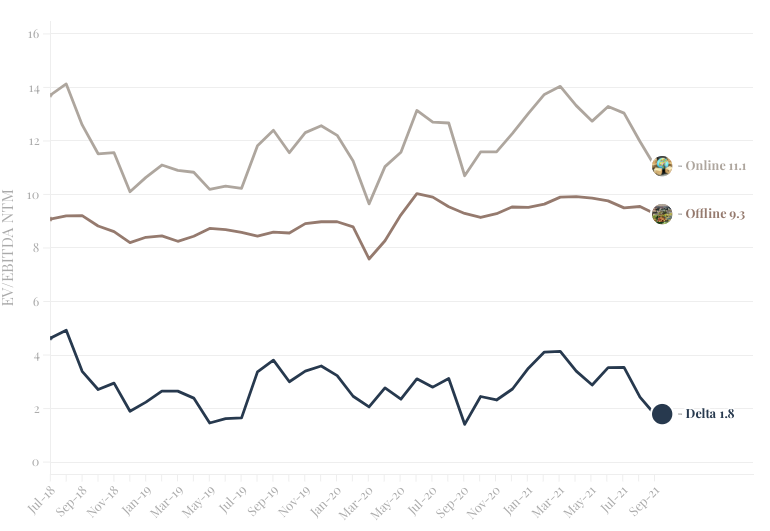

The shift in consumer preferences has increased the size of the eCommerce segment which is matching that of physical retail. The graph represents how the advent of Covid-19 pandemic has influenced the value of market multiples in the retail sector as a whole and in the two segments.

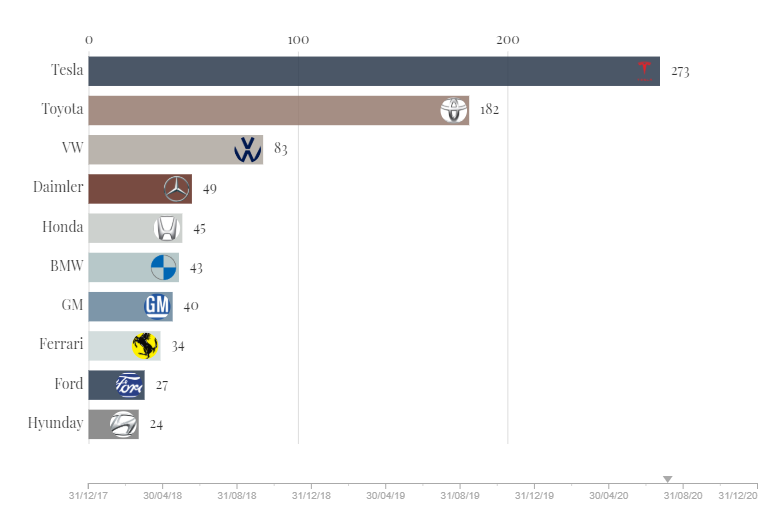

There are many expectations of change affecting the automotive sector, from the spread of electric motors to autonomous driving. The chart explores how these expectations have been reflected in the market capitalization of the major car manufacturers over the last three years.

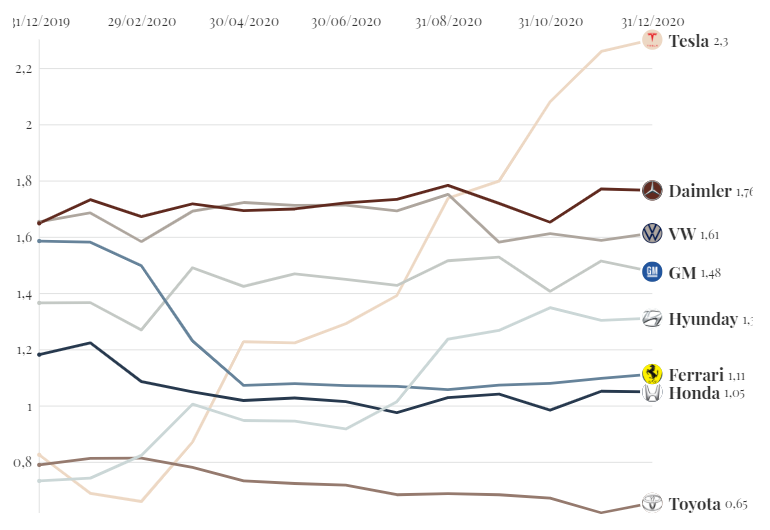

In 2020 there was a sudden rise in the market capitalization of Tesla, the Californian electric car manufacturer. This chart analyses what has happened to the stock volatility, measured by beta, of the major players in the sector over the past year.

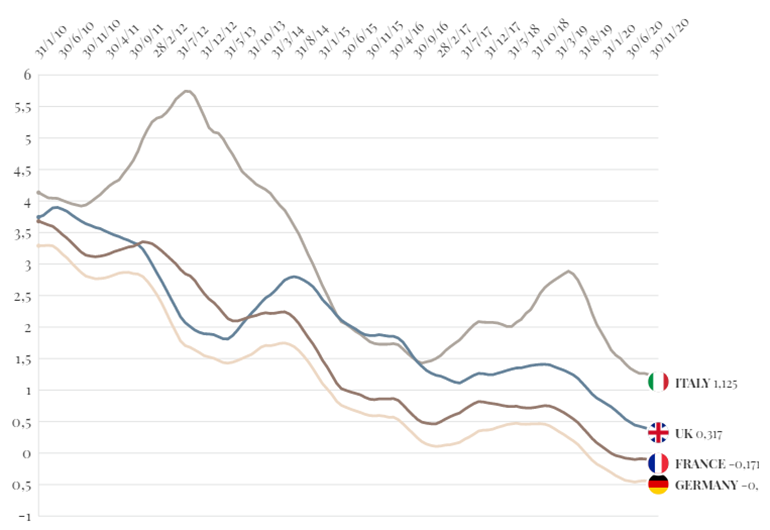

The yield on government bonds has not always been as low as in recent months. The chart shows the evolution of the yield on Italian 10-year BTPs (multi-year treasury bonds) and their German, French and UK counterparts from 2010 to December 2020.